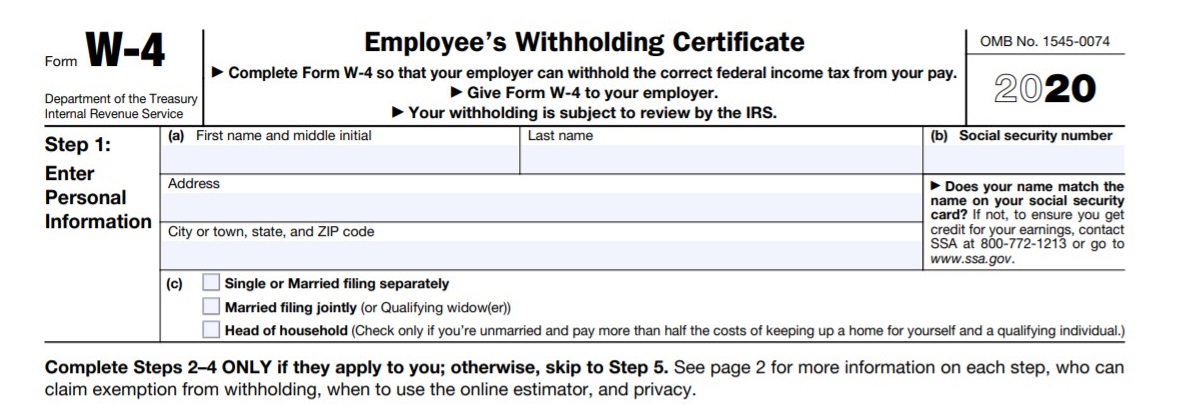

The IRS has released the final revised 2020 Form W-4 Employee’s Withholding Certificate. The 2020 form is substantially different from prior versions in order to comply with federal tax law changes that took place in the 2018 Tax Cuts and Jobs Act.

According to irs.gov, the redesigned Form W-4 makes it easier to have withholdings match tax liabilities. With the new design, the IRS aims to reduce the form’s complexity while increasing accuracy of the withholding system. The new version of Form W-4 replaces complicated worksheets with more straightforward questions.

Here’s what employers and employees need to know about the newly revised form.

- The redesigned form no longer uses allowances. Due to changes in the tax laws, personal exemptions or dependency exemptions cannot be claimed.

- Not all employees must complete a new form. New employees hired in 2020 and anyone making withholding changes during 2020 are required to use the new form.

- If employees do not submit a new form, withholding will continue based on their previously submitted form.

The IRS is however, recommending employees perform a “paycheck checkup” to see if they need to make adjustments to their current withholding. The IRS has a Tax Withholding Estimator available at www.irs.gov/W4App. It is helpful to have a recent paystub and tax return when using the calculator. The calculator will be updated in January to account for the 2020 tax tables.

Frequently Asked Questions about completing the new W-4 Form may be found at www.irs.gov/newsroom/faqs-on-the-draft-2020-form-w-4.